Tiny brightly coloured microbes live in Yellowstone park’s volcanic springs which can thrive in incredibly hot temperatures up to 235 C. These so called extremophiles are bright yellow, orange, blue and survive and by turning light into energy. Scientists have long been fascinated by their unique habitat and properties.

The microbes caught the eye of Thomas Jonas the CEO of Nature’s Fynd. The company now takes these microbes and with the aid of water has created a process which can turn sugar into protein. This protein can then be used as the basic building block of an artificial meat product.

Nature’s Fynd was founded to tackle greenhouse gas emissions through food production. The company can produce “meat” with 99 percent less land and greenhouse gases than the livestock equivalent. Nature’s Fynd is part of new wave of companies focused on utilising new technologies to reduce carbon emissions.

Why Climate Tech is a Critical Sector

As the threat of global heating grows the need for solutions grows more urgent. Climate tech is an industry focused on solving humanities biggest problem. 2021 has seen record breaking temperature across the world along with more instances of extreme weather, floods, wildfires and hurricanes. From rocky beginnings as cleantech a decade ago which saw a lot of money pumped into firms but few success stories (Tesla a notable exception).

Now a new wave of exciting companies is emerging which are utilising technology to transition society to a zero carbon future.

Proterra is a leading provider of heavy electric vehicles, producing buses, trucks and shuttles all with zero carbon emissions. Founded in 2004 the company is taking advantage of the fact that more companies and governments are switching to electric vehicles for their fleet. As the number of charging points and policies favouring electric vehicles grows so will the market for these vehicles.

Each degree of warming will make climate tech a more attractive sector. As the problem of global heating grows, the solutions needed will become more urgent.

Pachama allows companies purchase carbon credits and restore nature through forest projects. They use artificial intelligence to monitor the forests and protecting older trees and growing new trees to restore habitats.

Aclima measures greenhouse gas emissions and pollutants at a local level which allows its customers to identify where and how they are contributing to greenhouse gas emissions, giving them the information they need to take remedial action.

Climate tech firms can be divided into seven broad areas:

- Creating zero carbon transport (electric vehicles) or mass transport solutions.

- Developing solutions around agriculture, farming and forestry which reduce emissions or even create negative emissions (this could mean a venture like Pachama or vertical farming solutions).

- Decarbonising the built environment, firms that can decarbonise heating systems or make them more efficient. Or firms that can that make buildings with low carbon materials come under the climate tech umbrella.

- Renewable energy companies, the most obvious solution for many observers, this can mean the production of solar panels and wind turbines or firms which can optimise energy efficiency, distribution and usage.

- Companies which decarbonise industry through new techniques such as low or zero carbon cement.

- Companies which utilise machine learning and artificial intelligence to make use of data sources such as satellite imagery, physical sensors and temperature readings which create a detailed information around the rise of climate change.

- Carbon Capture and Storage is the most uncertain and unproven climate tech, but if deployed successfully could suck carbon out of the air and store it safely. Reducing the amount of carbon in the atmosphere could represent a silver bullet for climate change. But CCS has yet to be proven at scale.

The huge of scale of change required to get the world to net-zero is breath-taking. Estimates run into US$5-7 Trillion over the next couple of decades to hit current 2050 targets. The good news is that the sector is fast growing. In 2020 companies in Climate Tech raised capital three times faster than artificial intelligence. PWC put this figure at US$16 billion, a large amount but tiny compared to what it required.

How Disasters Could Drive the Climate Tech Sector

Perhaps ironically what will drive more investment and more demand for the products is each new piece of bad climate related news, every natural disaster will raise awareness about climate issues. The many pledges made at international conferences and by individual governments are also driving change.

For example, the EU recently published its sustainable finance taxonomy defining climate friendly activities. While many of the pledges are flawed and some may end up unfulfilled or ignored it does create a powerful sense of momentum.

Global giants Microsoft, Unilever and Amazon have all seen which way the corporate wind is blowing. These firms have all set up venture funds to back climate tech start-ups joining a stampede of new financial backers looking for the next growth story.

43 Unicorns and Counting

The business opportunities in this space are likely to rival previous tech booms and produce new Unicorns (tech firms worth a US$ 1 billion or more) and major new companies. Already there 43 Unicorns in the Climatetech sector, but many start-ups will get absorbed by rivals or simply not survive.

Climate tech differs from Cleantech (which experienced a boom/bust cycle a decade ago). Climate tech is focused on activities which reduce carbon emissions. Cleantech is broader and includes activities which help protect the environment such as water filtration or recycling, but not necessarily reducing carbon emissions.

Why Now? Climate Tech has hit a critical inflection point thanks to various factors:

Both demand from consumers and regulation from governments is driving the corporate sector to find new low carbon alternatives. The Paris Agreement, the EU Sustainable Taxonomy and the Task Force for Climate Related Climate Disclosures (TCFD) are all relatively new policy initiatives which

Energy is the most obvious sector for climate tech to disrupt. Solar and wind energy has already made a major impact on global energy production. Falling costs over the last decade (85 percent in the case of wind turbines) means that renewable energy is competitive with fossil fuels. But climate tech is wider than just energy production. For example, battery storage for cars or on an industrial level is increasingly a vital driver of decarbonization.

More efficient energy storage means that renewables become more effective as they can avoid the vagaries of the wind and sun. Grid management tools using machine learning and other techniques can also make for more efficient energy use. The market for electric vehicles pioneered by Tesla and the batteries which drive them is set to grow rapidly as car manufacturers shift production and governments look to ban their use.

Climate tech solutions can be divided into the vertical which deal with carbon emissions in one industry. For example, reducing the carbon loss from soil through precision agriculture or manufacturing process to make low or zero carbon concrete.

Alternatively horizontal solutions address carbon emissions across multiple sectors. Electric car batteries are a good example of this as they have allowed the car industry to shift to electric cars (EV), this encourages the use of solar and wind energy to produce the electricity to run the cars.

Machine learning (ML) is another horizontal tool which can cut across boundaries and solve problems. ML uses algorithms which can perform a task normally done by humans, such as identifying pictures of friends on social media, act as a IT support chat bot to solve software issues or collect and identify patterns in satellite imagery.

The seven broad areas in Climate Tech are outlined below:

Transport

Moving people and goods by land, air and sea takes up a lot of energy. Most transport is run on oil products which of course leads to greenhouse gas emissions. It makes sense that many climate tech firms are looking to shift and upset this sector.

Electric vehicle production whether this be car, bus or truck is a highly visible sign of climate tech. Of course, the source of the electricity is key. If the electricity is supplied by fossil fuels, then electric cars are not climate friendly. Electric vehicles are only as green as the source powering them. The production of electric vehicles can also be problematic thanks to the need for rare earth metals in the battery which can be environmentally destructive.

NIO is a Chinese car maker which focuses on making Telsa like electric autonomous vehicles. NIO are luxurious vehicles with ultra modern autonomous driving features. With many countries promising to phase out petrol driven cars, manufacturers are shifting to electric models.

Food and Agriculture

Farms and agriculture are increasingly recognised as both major source of greenhouse gas emissions (around a quarter of all emissions) and a difficult problem to solve because of humans need for huge quantities of food and in particular methane producing livestock. Many policy initiatives are unlikely to impact on agriculture as it has been exempted from carbon pricing.

This challenge has resulted in many of the most climate friendly and innovative solutions. Meat production is a major and growing source of greenhouse gases (especially methane) and there many ethical concerns around livestock farming. The answer is a global shift to a plant based diet.

But of course this desire clashes with people’s love of meat. Food production companies such as Viva and Beyond Meat have used technology to create alternative proteins – which taste and appear like meat or fish but are plant based. These products typically represent 90 percent less carbon emissions than their meat equivalents.

The market for plant based products has grown rapidly. The number of vegans and people demanding more plant based foods has grown rapidly in many western countries. The Michelin Guide recently awarded 81 stars to vegan and vegetarian restaurants. A powerful symbol that the world is taking vegetarian food seriously.

The earth and soil and peat are also a major source of carbon storage and depleted soils and. Regenerative agriculture can mitigate climate change and involves activities which improve soil health and sequester carbon and enhance water retention.

Regenerative agriculture includes practices such as cover cropping and conservation tillage which farmers have been doing for many years but too much of modern farming has become destructive to the land and the result in billions of tonnes of carbon being released from the soil each year

Gingko Bioworks are encouraging sustainable agriculture through testing strains of microbes. These microbes can be used to fix nitrogen in the roots of plants. This improves yields and reducing the need for nitrogen fertiliser (around 3 percent of global emissions).

Heavy Industry

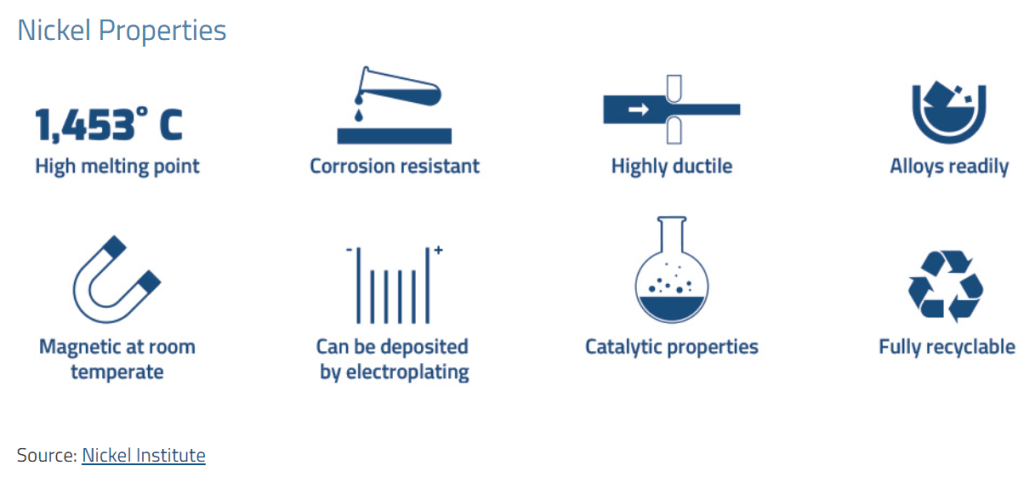

Heavy industry is the fastest growing source of carbon emissions. The world’s demand for goods and products is seemingly never ending. Metals, concrete, fertilisers, plastics, and fertilisers all produce large amounts of greenhouse gases during their creation. Companies that can reduce emissions, reduce the amount of raw materials or used or make production processes more efficient can be classed as climate tech.

For example, 3D printing companies such as EOS and GE Additive can reduce transportation costs by allowing companies to print components reducing emissions. Hybrit is a Swedish firm which is trying to develop zero carbon iron and steel production from energy source to manufacturing process. Hybrit are experimenting with using hydrogen instead of carbon or coke to aid the reduction process. The reduction removes the oxygen from the iron which is a key part of making steel. Traditionally it is done in a blast furnace and relies heavily on coke (a major carbon source).

The Built Environment

Buildings emit large amounts of carbon thanks to heating and cooling systems emitting heat. But the materials that are used to build houses, factories, road, bridges and all our other infrastructure needs also involve large amounts of energy. Just cement production alone amounts to around 8 percent of all carbon emissions globally.

Efforts are underway to try and reduce this amount by trying to capture the carbon emissions during the manufacturing process. Ideas include switching to different more climate friendly fuel sources and by substituting materials such as using coal ash and blast furnance slag instead of clinker.

Through energy efficiency measures such as modern heating systems, improved insulation, plus smart heat management (often using machine learning) emissions can be reduced. These measures can be introduced into existing homes, but of course it is easier to be put into new builds. Green construction methods cut up front carbon costs through green materials.

Airex is a UK company which uses sensors and smart ventilation to help reduce heat demand in buildings. By cutting energy use Airex can cut fuel bills and using sensors can identify poorly ventilated areas and improve air quality.

Renewable Energy and Storage

Wind turbines and solar panels are the most obvious symbols of climate tech. Across the world renewable energy options are becoming more widespread and cheaper. Widespread industrial battery storage now promises to store energy and overcome the problem of when the sun is not shining or wind not blowing.

Hydrogen promises to be an exciting new carbon free energy source. Hydrogen burns like natural gas but without the carbon emissions. Excess renewable energy created in times of low demand can create hydrogen. This hydrogen can be then stored, transported and used as a zero carbon power source. However, this technology is still in its infancy

Climate Capture and Storage

The most uncertain, controversial, and risky climate tech area is carbon capture and storage (CCS). This is seen by some as the holy grail of decarbonisation but by environmentalists as a distraction from carbon reduction efforts.

Extracting carbon from the air and storing in the ground on a massive scale could theoretically solve global heating. Environmentalists view CCS as a risky distraction from decarbonisation which offers false hope. It is perhaps no surprise that funding has been patchy in this sector. The uncertainty and long-time horizons around CCS make it unsuitable for venture capitalists which prefer faster returns and more established technologies.

However, one source namely oil companies have been the biggest backers of CCS – although results have been poor so far. Expect these experiments to continue as if successful it would potentially allow oil companies to capture the carbon they are responsible for releasing into the atmosphere. Some have speculated that the technology for injecting carbon into the ground after capture uses similar techniques to the deep underground drilling that oil companies have such strong expertise in .

Climate Data and Analysis

The launch of many nano satellites has led to an explosion in the amount and quality of earth data captured. This has led to many new companies emerge to provide data on climate risks and forecasting. Companies like Jupiter Intelligence and Sust Global provide detailed information on physical climate risks for organisations. Understanding how the climate may create risks on a granular level allows clients to how extreme weather, drought, sea level rise and many other factors impact their assets.

Firms in this space use machine learning to process and sift through the huge amounts of data and turn them into actionable insights or financial signals. As well as climate risks this information can be used to monitor crop production, deforestation or reforestation rates (which can feed into sustainability ratings) and tracking natural disasters in real time to aid recovery efforts.

What’s Next?

For the success of Climate tech to continue there are several hurdles which need to be overcome. Firstly, financing needs to continue at an even faster rate, which in turn is dependent on the success of the companies involved in the sector.

Secondly the regulatory environment needs to shift further towards climate tech. This means actions like the phasing out of fossil fuel subsidies which prop up the oil and gas sector. It also means more initiatives like the EU sustainable Taxonomy which determines climate friendly activities. However, the problem is that if the legislation or regulation is too complex there is a risk that it will prove difficult for start-ups to navigate. This gives an advantage to larger firms with existing resources and could stifle competition.

Another limiting factor is lack of talented people in the industry. Climate tech is a young industry and its use of cutting-edge concepts like artificial intelligence means that there is a limited pool of workers to drawn upon. However, as the sector grows and the demand for such skills grow, so will the number of people attracted to it and they will develop the appropriate skills.

The rise of social media industry shows us how quickly a new sector can arise and dominate. The combination of new technology, the growing urgency of the climate crisis and the shift in the regulatory environment means that Climate Tech has a bright future.